IRS Form 2290: Explaining the Heavy Highway Vehicle Use Tax

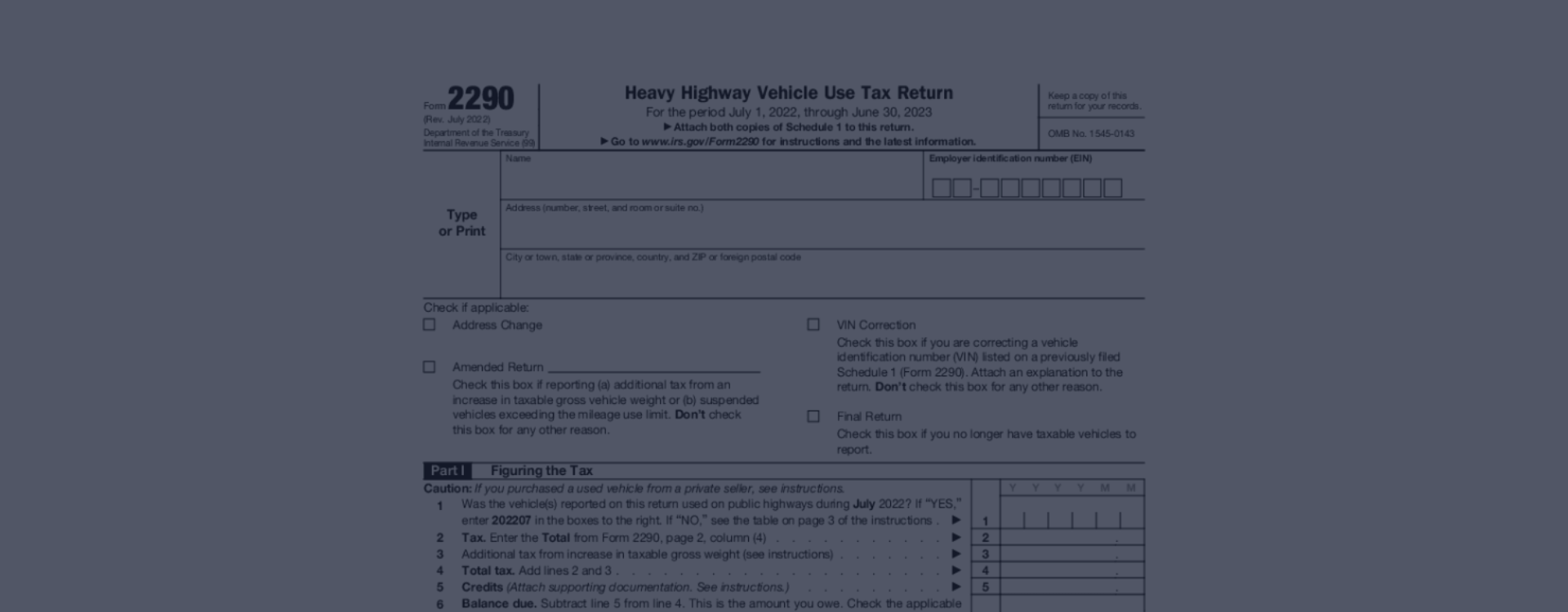

Heavy Highway Vehicle Use Tax Return is a vital document that owners and operators of vehicles weighing 55,000 pounds or more must be filed annually. The 2290 tax form printable is essential for reporting the federal excise tax imposed on heavy highway vehicles, ensuring the appropriate taxes amount is paid and the vehicle is legally registered. The blank template can be downloaded in a PDF format, making it easily accessible and simple to complete.

Check Out the Instructions & Download the PDF

To provide proper guidance and assistance in completing this necessary document, the website 2290taxform.us offers invaluable resources for taxpayers. The site includes comprehensive 2290 tax form instructions, which simplify the process and help taxpayers avoid making costly errors. Additionally, the website presents a 2290 tax form example, demonstrating how the application should be filled out correctly. Through the use of these resources, taxpayers can confidently submit their 2290 tax form PDF, knowing they have accurately met the necessary requirements and contributed to the upkeep and maintenance of the nation's highways.

IRS Form 2290: Terms for Filing HVUT Return

Individuals and businesses in the United States that operate heavy highway vehicles with a gross mass of 55,000 pounds or more are required to fill out the 2290 form. It’s used to report and pay the Heavy Vehicle Use Tax (HVUT) to the Internal Revenue Service (IRS). It is essential for taxpayers to submit the 2290 copy annually to avoid penalties and maintain compliance with federal regulations.

An example of a person who must file the 2290 form is George Smith, a 45-year-old independent truck driver based in California. George owns a fleet of three heavy-duty trucks that he uses to transport goods across the country. Each of his trucks has a gross weight of over 60,000 pounds, which puts him in the category of taxpayers required to report and pay the HVUT. To comply with federal regulations, George should print the 2290 form in 2023 and submit it to the IRS, along with the appropriate tax payment.

Another individual who must file the 2290 form is Susan Johnson, a 36-year-old entrepreneur who owns a construction company in Florida. Susan's company operates multiple heavy vehicles, such as dump trucks and cranes, each weighing over 55,000 pounds. As the owner of the company, Susan is responsible for reporting and paying the HVUT for these heavy vehicles. She can find a Form 2290 example online to help her understand the information required and accurately complete the copy.

Fill Form

The 2290 Tax Form Main Tasks

-

![Vehicle Registration]() Vehicle RegistrationThe document is essential for registering vehicles with a taxable gross weight of 55,000 pounds or more.

Vehicle RegistrationThe document is essential for registering vehicles with a taxable gross weight of 55,000 pounds or more. -

![Tax Calculation]() Tax CalculationIt calculates the Heavy Highway Vehicle Use Tax (HVUT) owed by truck owners, ensuring accurate taxes.

Tax CalculationIt calculates the Heavy Highway Vehicle Use Tax (HVUT) owed by truck owners, ensuring accurate taxes. -

![Proof of Payment]() Proof of PaymentIt allows taxpayers to receive a Schedule 1, which serves as proof of taxes and is crucial for vehicle registration renewal.

Proof of PaymentIt allows taxpayers to receive a Schedule 1, which serves as proof of taxes and is crucial for vehicle registration renewal.

Blank Form 2290: How to Fill Out Printable Sample

Filling out the printable tax form 2290 can be daunting, but with this simple guide, you'll be able to complete it correctly and efficiently. The declaration, also known as the Heavy Highway Vehicle Use Tax Return, is crucial for those who operate heavy trucks on public highways. To ensure you avoid any errors, follow these steps.

- Before starting, download the IRS Form 2290 PDF from any trustworthy website. This will ensure that you have the most up-to-date copy for the current tax year, such as the IRS 2290 form 2023.

- Read the instructions carefully, as they contain valuable information on who must file and the specific requirements for your situation.

- When filling out the sample, pay close attention to the details.

- Accurately enter your Employer Identification Number (EIN), name, and address in the designated boxes. Be sure to include each vehicle's vehicle identification number (VIN) and taxable gross weight.

By following these guidelines, you'll be well on your way to successfully filing your Form 2290 and staying compliant with IRS requirements.

2290 Online Form

One common mistake to avoid is the use of incorrect tax computation. Refer to the tax computation table provided in the instructions to determine the appropriate amount due. Double-check your calculations to ensure accuracy. Filing the IRS Form 2290 online can simplify the process and reduce the likelihood of errors. The IRS e-file system will automatically check for errors and provide immediate confirmation of your submission. Remember to keep a copy of the completed 2290 sample for your records.

File OnlineDue Date

The deadline to file tax form 2290 in 2023 is August 31st. This date is chosen because the tax period for this form starts on July 1st and runs through June 30th of the following year. It is due on the last day of the second month after the tax period begins, giving taxpayers ample time to gather information and complete the necessary documentation.

Regarding the possibility of an extension, there isn't an option to request additional time for submitting an IRS Form 2290 printable version. As a result, taxpayers must ensure they meet the deadline to avoid penalties and interest charges.

IRS Penalization System

It is essential to provide accurate information when filing Form 2290: Heavy Highway Vehicle Use Tax Return, as providing false information or failing to file the completed copy can lead to severe penalties. Some of the potential penalties a person might face for filing the document incorrectly or providing fake information include the following:

- If an individual does not submit copy by the due date or fails to file altogether, they may be penalized. This penalty is typically 4.5% of the tax due and is assessed monthly for up to five months.

- If an individual does not pay the tax due, they may be subject to an additional penalty, which is generally 0.5% of the unpaid amount, and can increase each month the tax remains unpaid.

- Providing false or fraudulent information can lead to fines, and criminal penalties, such as imprisonment.

- If an individual file it more than 60 days late, they may be subject to a minimum penalty of $435 or 100% of the tax due, whichever is less.

To avoid these penalties, it is crucial to follow the tax form 2290 instructions carefully and ensure that all information provided on the sample is accurate and complete.

FAQs on IRS Form 2290: Answers to Your Heavy Vehicle Tax Queries

- What is the 2290 tax form, and who needs to file it?This federal tax form is required for individuals and businesses operating vehicles with 55,000 pounds taxable gross weight or more on public highways. Trucking companies, owner-operators, and other heavy vehicle operators must file this form annually to report and pay the tax.

- Where can I download the 2290 form for 2023?You can download it from the official IRS website. It is essential to use the most recent version of the template to ensure accurate filing and avoid potential penalties for non-compliance.

- Can you provide a sample of the 2290 form to help me understand how to fill it out?It can be found on the IRS website or through various tax preparation software providers. These samples will contain detailed instructions on how to complete the federal 2290 form, as well as examples of correctly filled-out sections.

- Is it possible to print the 2290 form for 2022, or do I need to file it electronically?You can print it out and file it by mail if you have 24 or fewer vehicles to report. However, the IRS mandates electronic filing for taxpayers with 25 or more vehicles, as it streamlines the process and reduces errors.

- Can you give me a Form 2290 example of when this tax is due?If you first used a taxable vehicle on a public highway in July 2023, your Form 2290 would be due by August 31, 2023. The tax period runs from July 1 to June 30 of the following year, and the form is usually due by the last day of the month following the first month of use.

Tax Form 2290 for 2023: Instructions & Examples

2023 IRS Form 2290 Instructions Imagine this scenario: You've recently purchased a new heavy-duty truck for your business, and you're excited about the opportunities it will bring. But amidst the excitement, you realize there are some tax obligations you need to fulfill. Enter the world of tax form 2290 instructions, where heavy v...

2023 IRS Form 2290 Instructions Imagine this scenario: You've recently purchased a new heavy-duty truck for your business, and you're excited about the opportunities it will bring. But amidst the excitement, you realize there are some tax obligations you need to fulfill. Enter the world of tax form 2290 instructions, where heavy v... - 3 April, 2023

- Printable 2290 Tax Form & Fillable PDF As a finance professor with extensive experience in taxation, I am often asked about the various forms and procedures associated with the Internal Revenue Service (IRS). One such form is the IRS Form 2290, also known as the Heavy Highway Vehicle Use Tax Return. In this article, I will discuss the pr...

- 31 March, 2023

- IRS Form 2290: Heavy Highway Vehicle Use Tax Return When it comes to taxes, the highway is no exception. If you own a heavy highway vehicle weighing 55,000 pounds or more, chances are you've encountered the enigmatic IRS Form 2290. This form, officially known as the Heavy Highway Vehicle Use Tax Return, is used to calculate and pay the federal excise...

- 30 March, 2023

Print Out IRS Form 2290

Get FormPlease Note

This website (2290taxform.us) is not an official representative, creator or developer of this application, game, or product. All the copyrighted materials belong to their respective owners. All the content on this website is used for educational and informative purposes only.